Salon Expenses Spreadsheet | Free Customizable Template

Here is a customizable salon expenses spreadsheet template for keeping track of all monthly expenses. It is also ideal for self-employed stylists, makeup artists, nail artists, and beauticians.

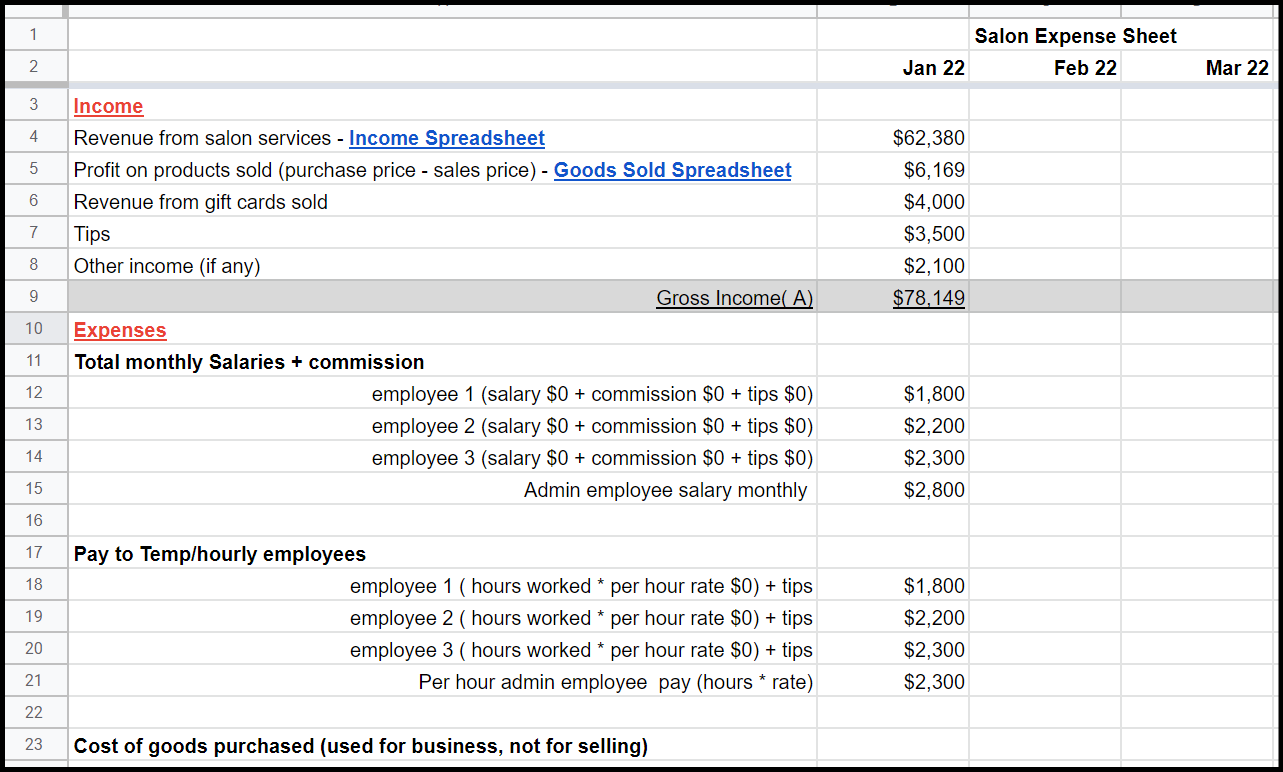

Salon Expenses Sheet for Hair Stylists and Beauty Salons

We have included the most common hair and beauty salon monthly expenses. You can add the additional items and remove the ones not applicable to your business.

You need 3 main spreadsheets to keep track of salon revenue, expenses, and profits.

- Salon income spreadsheet

- Cost of goods sold spreadsheet (If you’re generating extra income by selling retail products in your salon like shampoos, nail polishes, hair oils, etc.)

- Salon expense spreadsheet

- Salon expenses template (below is the explanation)

To access the above income spreadsheet, use this template.

The above beauty salon expense sheet is simple and self-explanatory. Here are the expenses we have included and an overview of how to calculate them.

Salon Income

We have included 4 types of common income sources for beauty, hair, and nail salons.

- Revenue from salon services: This will include the total of all the services you sold and the rate for each service. It includes cash, payment through credit cards/debit cards, bank transfer, digital wallets, and checks. Include tips under this head. Here’s a template for the salon income spreadsheet.

- Profit on products sold (purchase price – sales price): If you’re selling hair and beauty products in your salon, use this profit from goods sold template. This is a complicated calculation, but to simplify it, we have included net profit from the product sold. It works if you have a low number of transactions.

- Revenue from gift cards sold: Keep all the gift cards sold amount here, under a separate head instead of having them added to the services sold. Because these gift cards may or may not be redeemed yet. But irrespective of the service provided, you have still made an income just by selling them.

- Other income (if any): If you have any other income such as selling video tutorials, subleases, interest, etc.

Salon Expenses

We have included the most common expenses for every salon, irrespective of their nature, i.e., hair, beauty, or nail salon.

Here’s a detailed article on 3 cost-cutting secrets for salons.

Salaries

Add monthly salaries, commissions, and tips. If you have per-hour salon staff, calculate hours worked and per-hour rate. Include admin and front desk employees’ salaries, too.

Cost of goods purchased

The salon needs a large number of inventories to run the business. Some of them are industry specific, while some a common for all types of salons.

Note: Add items that you’re using in salon operations and not for selling purposes. If you’re selling retail products like shampoos, lotions, hair oils, etc. in your salon, you need to maintain a separate spreadsheet for profit from goods sold.

For example, items like uniforms, aprons, towels, doormats, gloves, wiping and cleaning papers/cloths, chairs, and other furniture are needed in all types of salons.

While some items are specific to the type of services you provide, here are the 3 prominent examples we have included in our salon expenses spreadsheet.

- Hair salons: If you’re making an expense sheet for a hair stylist or hair salon, add expenses like scissors, blow dryers, trimmers, chemicals, hair spray, combs/brushes, straighteners, curing lamps, etc. To access the complete list, please go to the hair stylist expense sheet template. Most of the hair salons offer shaving facilities as well. Include all the items related to shaving such as shaving cream, aftershave location, razors, trimmers, etc.

- Beauty salon: You will get a detailed list of all the expenses in this beauty salon expense sheet. The most common expenses for beauty salons are facial creams, lotions, tweezers, toner, steaming machines, foundations, lipsticks, etc. If your beauty salon offers hair removal services, include all the needed items here such as various types of waxes, spatula, strips, etc.

- Nail Salon: The most common expense for a nail salon is a variety of nail paints along with manicure and pedicure kits. You can use the above sheet as a nail salon accounting spreadsheet and add all other expenses other than those we have mentioned there.

Technology Expenses

Nowadays, all salons need some or other software for online booking, tracking employees’ schedules and appointments, payroll, bookkeeping, email marketing, etc. You can reduce the technology costs dramatically if you use 100% free software like Yottled.

Another big technology expense is credit card fees which tend to take approximately 3% of your revenue. You can transfer these fees to your customers’ final bills and instantly save 3% of your revenue. Yottled provides this facility. Read how Yottled is the best payment card processor for salons.

Salon Business Expenses

These are fixed and semi-variable expenses such as rent or monthly installments, utility bills, marketing expenses, accounting, and legal expenses, and insurance.

Final Words on Salon Expenses Spreadsheet

Use Yottled’s free beauty salon budget spreadsheet for tracking salon income and expenses. Also, check out our template for salon income. It is ideal for hair stylists and small salons. If you’re looking for ways to cut costs, check out our other article on 3 tricks to reduce salon costs.